market news summary

Industrial output in China grew at a faster pace than expected in August, signalling the positive role recent support measures played in stabilizing the sluggish economic recovery. According to data released by the National Bureau of Statistics on Friday, September 15, industrial production increased by approximately 4.5% in August on a year-on-year basis, compared to a 3.7% increase in July, and surpassing expectations of a 3.9% rise.

In Europe, European stock markets closed higher on Thursday as investors in the region assessed the European Central Bank’s decision to raise interest rates once again. The European Central Bank decided to increase interest rates by 25 basis points, marking the tenth consecutive increase, bringing the main interest rate to 4%, the highest ever.

Dollar Index (USDX)

The dollar index, which measures the currency against major counterparts, declined by 0.11% to 104.93 as expectations grew that the Federal Reserve would maintain interest rates at their current levels next week.

Pivot Point: 105.10

| Resistance level | Support level |

| 105.65 | 104.75 |

| 105.95 | 104.25 |

| 106.50 | 103.90 |

Spot Gold (XAUUSD)

Gold prices rose by 0.22% to $1,916.80 per ounce, supported by a slight decline in the dollar during the Asian session today.

Pivot Point: $1,908

| Resistance level | Support level |

| 1915 | 1903 |

| 1920 | 1896 |

| 1927 | 1891 |

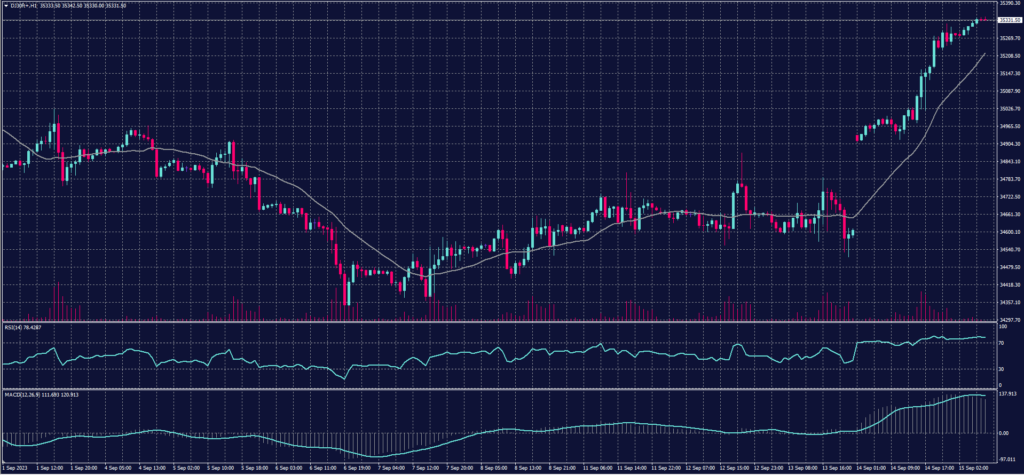

Dow Jones Index (DJ30ft – US30)

US indices closed with collective gains yesterday, supported by investor optimism about interest rate stability following better-than-expected economic data.

Retail sales exceeded expectations in August due to rising gasoline prices, while initial claims rose to 220,000.

The Dow Jones index rose by 0.96%, equivalent to 331 points, marking its highest daily gain in 5 weeks, closing above the 34,900 level. Additionally, both the S&P 500 and the Nasdaq indices rose by approximately 0.8% each, achieving their second consecutive daily gains.

Pivot point: 35170

| Resistance level | Support level |

| 35430 | 35025 |

| 35580 | 34765 |

| 35840 | 34615 |

US Crude (USOUSD)

Oil prices rose yesterday to their highest levels this year, as supply concerns outweighed worries about economic growth weakness and rising US crude inventories.

Brent crude rose by $1.82, or 1.98%, to settle at $93.70 per barrel, after touching $93.89, its highest level since November 2022.

West Texas Intermediate (WTI) crude gained about $1.64, or 1.85%, to reach $90.16 per barrel, closing above $90 for the first time since November.

Pivot point: 90.05

| Resistance level | Support level |

| 91.40 | 89.30 |

| 92.15 | 87.95 |

| 93.50 | 87.20 |

Risk Warning

This material provides real-time market analysis from contributing analysts. Please note that any views expressed in this material do not constitute operational advice. It is important to assess your risk tolerance and make independent trading decisions. STARTRADER holds no responsibility for any trading consequences that may arise from relying on the views expressed in this material.

Tags

Open Live Account

Please enter a valid country

No results found

No results found

Please enter a valid email

Please enter a valid verification code

1. 8-16 characters + numbers (0-9) 2. blend of letters (A-Z, a-z) 3. special characters (e.g, !a#S%^&)

Please enter the correct format

Please tick the checkbox to proceed

Please tick the checkbox to proceed

Important Notice

STARTRADER does not accept any applications from Australian residents.

To comply with regulatory requirements, clicking the button will redirect you to the STARTRADER website operated by STARTRADER PRIME GLOBAL PTY LTD (ABN 65 156 005 668), an authorized Australian Financial Services Licence holder (AFSL no. 421210) regulated by the Australian Securities and Investments Commission.

CONTINUEImportant Notice for Residents of the United Arab Emirates

In alignment with local regulatory requirements, individuals residing in the United Arab Emirates are requested to proceed via our dedicated regional platform at startrader.ae, which is operated by STARTRADER Global Financial Consultation & Financial Analysis L.L.C.. This entity is licensed by the UAE Securities and Commodities Authority (SCA) under License No. 20200000241, and is authorised to introduce financial services and promote financial products in the UAE.

Please click the "Continue" button below to be redirected.

CONTINUEError! Please try again.