market news summary

Morgan Stanley believes that the United States will avoid the expected widespread economic recession, supported by the flexibility of the labor market, which can withstand interest rate hikes by the Federal Reserve this year.

They added: There is a clear slowdown in the labor market, however, the job gains rate has been very strong, and we believe that contributes to spending flexibility. European indices declined at the end of Tuesday’s session, as investors awaited the release of corporate earnings results. At the end of the session, the STOXX600 index rose by less than 0.1% to reach 461 points, while the German DAX declined by 0.26% to reach 16,039 points. The UK’s FTSE dropped by about 0.1% to 7,519 points, and the French CAC declined by 0.23% to 7,369 points.

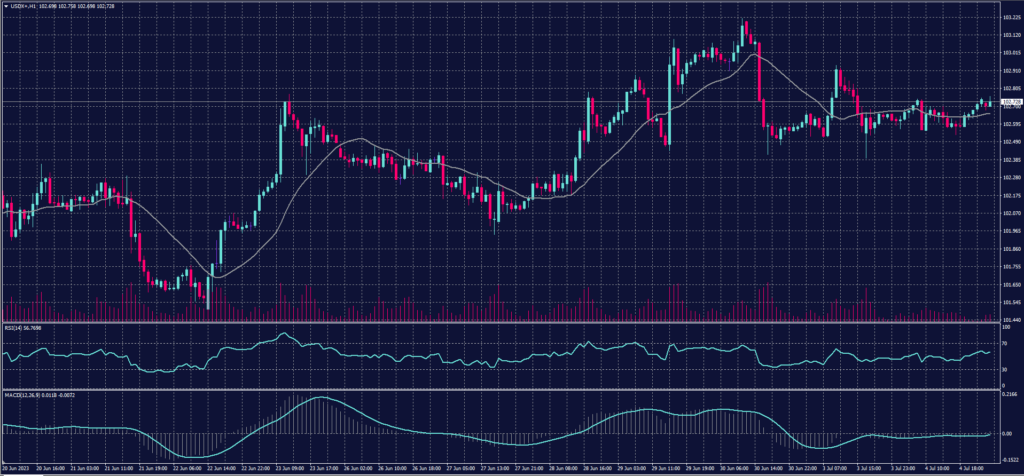

Dollar Index (USDX)

The dollar index rose by 0.1% as investors closely monitored the minutes of the Federal Open Market Committee meeting, which will provide insights into the expected monetary tightening moves. On the other hand, markets are awaiting the non-farm payroll data, unemployment rates, and wage rates, which will indicate the position and strength of the U.S. economy.

Pivot point: 102.65

| Resistance level | Support level |

| 102.80 | 102.50 |

| 103.10 | 102.25 |

| 103.35 | 102.00 |

Spot Gold (XAUUSD)

Gold prices rose on Tuesday, July 4th, amid light trading due to the U.S. Independence Day holiday. However, the rise of the dollar limited the gains at a time when traders await further economic data later in the week for indications of the Federal Reserve’s future interest rate hike plans.

Spot gold prices rose by 0.2% to reach $1,925.56 per ounce, and similarly, U.S. gold futures rose by a similar percentage to $1,932.30.

Pivot point: 1925

| Resistance level | Support level |

| 1930 | 1920 |

| 1936 | 1914 |

| 1941 | 1909 |

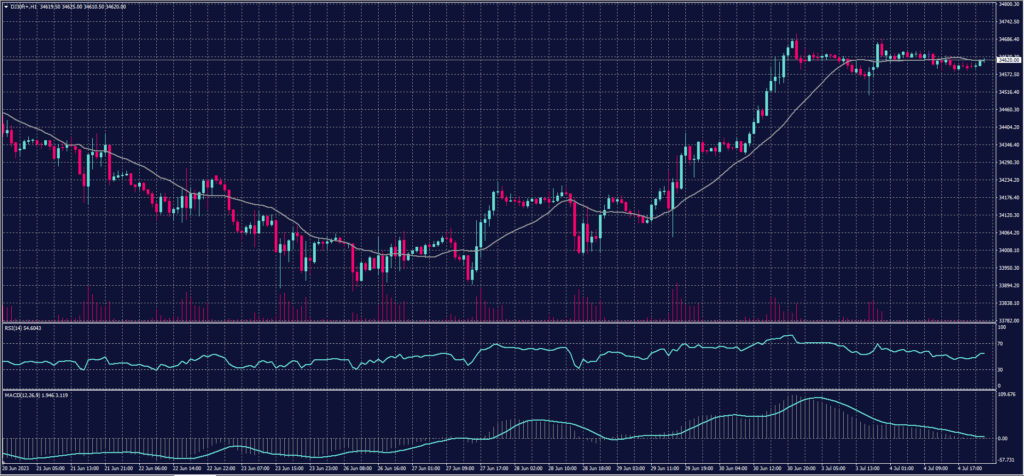

Dow Jones Index (DJ30ft – US30)

Expectations for the S&P 500 index are being raised for the upcoming period, as markets predict it to reach its all-time high by the end of this year.

The S&P 500 index concluded the first half of the current year with a rise of approximately 15.9%, marking its best first-half performance since 2019. Additionally, the 30-stock Dow Jones index had modest gains of 3.8%.

Pivot point: 34610

| Resistance level | Support level |

| 34715 | 34520 |

| 34800 | 34380 |

| 34905 | 34065 |

US Crude (USOUSD)

Oil prices rose at the close of trading on Tuesday, July 4th, as the market evaluated the impact of Russia and Saudi Arabia’s decision to cut production next month, amid weak global economic prospects.

Saudi Arabia decided to extend the voluntary production cut of around one million barrels per day, which it began implementing this month, for an additional month. Meanwhile, Russia decided to reduce its crude oil exports by 500,000 barrels per day in August. Algeria also decided to increase its voluntary production cut by 20,000 barrels per day next month.

Pivot point: 70.70

| Resistance level | Support level |

| 71.60 | 70.15 |

| 72.20 | 69.30 |

| 73.05 | 68.69 |

Risk Warning

This material provides real-time market analysis from contributing analysts. Please note that any views expressed in this material do not constitute operational advice. It is important to assess your risk tolerance and make independent trading decisions. STARTRADER holds no responsibility for any trading consequences that may arise from relying on the views expressed in this material.

Tags

Open Live Account

Please enter a valid country

No results found

No results found

Please enter a valid email

Please enter a valid verification code

1. 8-16 characters + numbers (0-9) 2. blend of letters (A-Z, a-z) 3. special characters (e.g, !a#S%^&)

Please enter the correct format

Please tick the checkbox to proceed

Please tick the checkbox to proceed

Important Notice

STARTRADER does not accept any applications from Australian residents.

To comply with regulatory requirements, clicking the button will redirect you to the STARTRADER website operated by STARTRADER PRIME GLOBAL PTY LTD (ABN 65 156 005 668), an authorized Australian Financial Services Licence holder (AFSL no. 421210) regulated by the Australian Securities and Investments Commission.

CONTINUEImportant Notice for Residents of the United Arab Emirates

In alignment with local regulatory requirements, individuals residing in the United Arab Emirates are requested to proceed via our dedicated regional platform at startrader.ae, which is operated by STARTRADER Global Financial Consultation & Financial Analysis L.L.C.. This entity is licensed by the UAE Securities and Commodities Authority (SCA) under License No. 20200000241, and is authorised to introduce financial services and promote financial products in the UAE.

Please click the "Continue" button below to be redirected.

CONTINUEError! Please try again.