Market News Summary

Consumer sentiment in the Eurozone has worsened during the current October, according to preliminary data released by the European Commission on Monday. The Consumer Confidence Index in the Eurozone, which includes 20 countries, decreased to -17.9 points this month compared to -17.8 points last month, while analysts had expected it to drop to -18.3 points.

Traders are anticipating several events this week, including the European Central Bank meeting, the release of US Gross Domestic Product data, and the preferred inflation gauge of the Federal Reserve.

Dollar Index (USDX)

The US dollar declined against a basket of currencies yesterday, following the retreat of US Treasury bond yields from the earlier 5% level they reached during the session. Traders are awaiting new US economic data scheduled to be released later this week.

Furthermore, the yield on US 10-year Treasury bonds dropped on Monday after briefly rising above 5.0%, reaching a level not seen since July 2007. It had briefly attempted to extend its reach the previous week and posed a greater threat to economic slowdown due to increased borrowing costs.

Pivot Point: 105.60

| Resistance level | Support level |

| 105.90 | 105.10 |

| 106.45 | 104.75 |

| 106.75 | 104.25 |

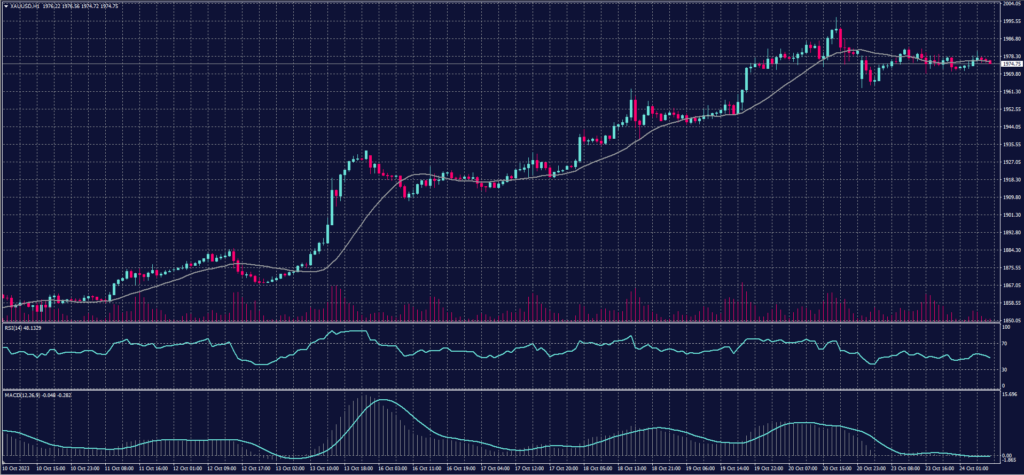

Spot Gold (XAUUSD)

Gold prices, often sought as a safe haven, experienced a slight decline on Monday, momentarily halting their upward momentum that had taken them close to the $2,000 mark in the previous session. Traders are closely monitoring further developments in the Middle East conflict and upcoming US economic data.

The spot price of gold saw a 0.3% decrease, resting at $1,976.19 per ounce. Meanwhile, US gold futures settled 0.3% lower at $1,987.80.

Pivot Point: 1972

| Resistance level | Support level |

| 1982 | 1962 |

| 1992 | 1953 |

| 2002 | 1942 |

Dow Jones Index (DJ30ft – US30)

The US stock indices closed with mixed results on Monday as bond yields fell, diverting investor attention toward corporate earnings and economic data. Investors are eagerly anticipating the results of about one-third of the listed companies this week, including giants like Microsoft, Alphabet, and Amazon.

Among the 86 companies in the S&P 500 that have reported their earnings, a remarkable 78% have surpassed expectations. Currently, there are expectations that third-quarter earnings will grow by a modest 1.2% on a yearly basis, slightly lower than the 1.6% anticipated earlier this month.

The Dow Jones index declined by approximately 0.6%, equivalent to 191 points, marking its fourth consecutive daily loss. In contrast, the Nasdaq index rose by about 0.3%, rebounding from its lowest levels in five months, supported by interest-rate-sensitive stocks following the decline in bond yields.

Pivot Point: 33165

| Resistance level | Support level |

| 33320 | 32965 |

| 33515 | 32815 |

| 33665 | 32620 |

US Crude Oil (USOUSD)

Oil prices declined by more than 2% on Monday as diplomatic efforts in the Middle East were strengthened in an attempt to contain the conflict in Gaza, reducing investor concerns about potential supply disruptions.

Brent crude futures dropped by $2.33, equivalent to 2.5%, settling at $89.83 per barrel. Meanwhile, US West Texas Intermediate (WTI) crude futures decreased by $2.59 or 2.9% to $85.49 per barrel at the close.

Pivot Point: 86.55

| Resistance level | Support level |

| 87.75 | 84.85 |

| 89.40 | 83.65 |

| 90.60 | 81.95 |

Risk Warning

This article provides real-time market analysis from contributing analysts. Please note that any views expressed in this article do not constitute operational advice. It is important to assess your risk tolerance and make independent trading decisions. STARTRADER holds no responsibility for any trading consequences that may arise from relying on the views expressed in this article.

Tags

Open Live Account

Please enter a valid country

No results found

No results found

Please enter a valid email

Please enter a valid verification code

1. 8-16 characters + numbers (0-9) 2. blend of letters (A-Z, a-z) 3. special characters (e.g, !a#S%^&)

Please enter the correct format

Please tick the checkbox to proceed

Please tick the checkbox to proceed

Important Notice

STARTRADER does not accept any applications from Australian residents.

To comply with regulatory requirements, clicking the button will redirect you to the STARTRADER website operated by STARTRADER PRIME GLOBAL PTY LTD (ABN 65 156 005 668), an authorized Australian Financial Services Licence holder (AFSL no. 421210) regulated by the Australian Securities and Investments Commission.

CONTINUEImportant Notice for Residents of the United Arab Emirates

In alignment with local regulatory requirements, individuals residing in the United Arab Emirates are requested to proceed via our dedicated regional platform at startrader.ae, which is operated by STARTRADER Global Financial Consultation & Financial Analysis L.L.C.. This entity is licensed by the UAE Securities and Commodities Authority (SCA) under License No. 20200000241, and is authorised to introduce financial services and promote financial products in the UAE.

Please click the "Continue" button below to be redirected.

CONTINUEError! Please try again.